Five Star Credit Union: Your Ultimate Guide To Financial Excellence

When it comes to managing your finances, trust is everything. And that’s exactly where Five Star Credit Union steps in. As a leading financial institution, Five Star Credit Union has been helping members achieve their financial goals with personalized services, competitive rates, and a community-focused approach. Whether you’re looking for loans, savings accounts, or investment options, Five Star Credit Union has got your back. So, buckle up as we dive deep into what makes this credit union stand out from the rest.

Let’s be honest—choosing the right financial institution can feel overwhelming. With so many options out there, it’s easy to get lost in the maze of banking jargon and confusing terms. But don’t sweat it! Five Star Credit Union simplifies the process by offering transparent services and putting members first. This isn’t just another bank; it’s a place where you’re treated like family.

From its humble beginnings to becoming a powerhouse in the financial world, Five Star Credit Union has earned a reputation for reliability and trustworthiness. In this article, we’ll break down everything you need to know about Five Star Credit Union, including its services, benefits, and why it might be the perfect fit for your financial needs. Let’s get started!

Read also:Sydney Thomas Ring Girl The Glamorous Face Of The Fighting World

Table of Contents

- About Five Star Credit Union

- The Journey: A Brief History

- Membership Benefits

- Services Offered

- Loan Options

- Savings Accounts

- Competitive Rates

- Embracing Technology

- Community Involvement

- Frequently Asked Questions

About Five Star Credit Union

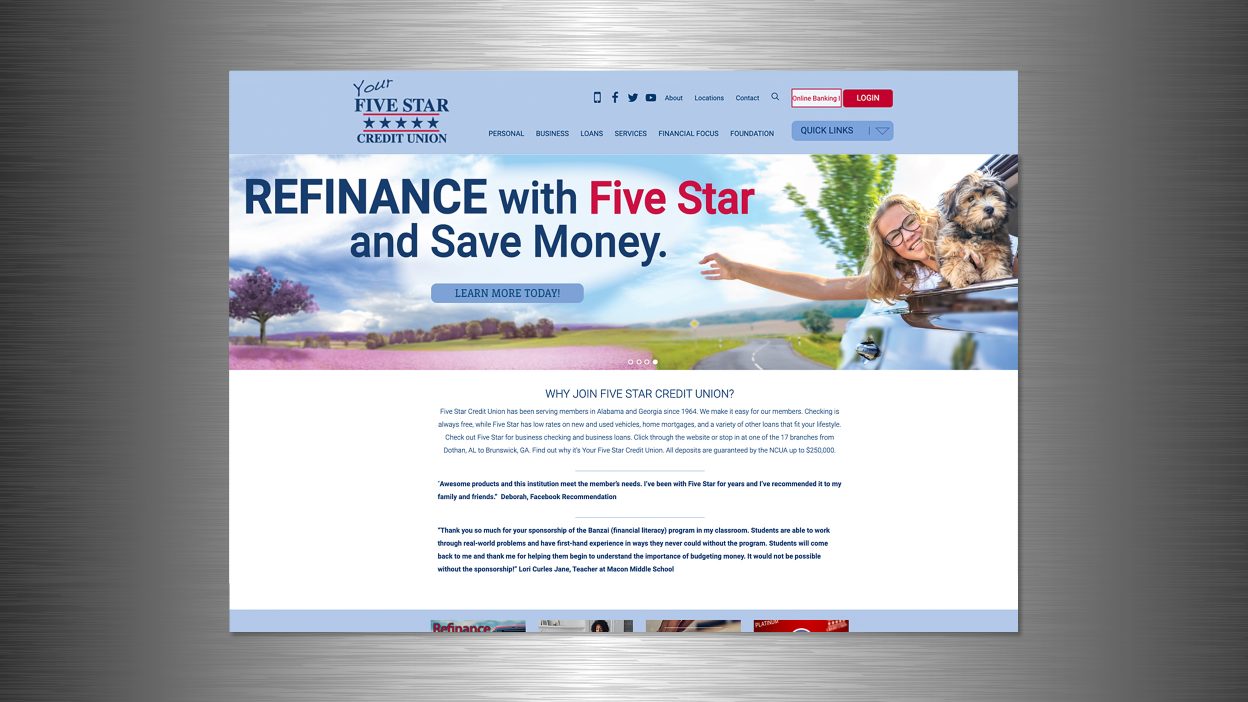

Five Star Credit Union is more than just a financial institution—it’s a community-driven organization dedicated to empowering its members. Established with a mission to provide affordable financial services, Five Star Credit Union has grown to become one of the most trusted names in the industry. Unlike traditional banks, credit unions operate as not-for-profit organizations, meaning any profits are reinvested into member benefits rather than shareholders’ pockets.

What sets Five Star Credit Union apart is its commitment to personalized service. Whether you’re opening your first savings account or securing a mortgage, you’ll find that the team at Five Star Credit Union goes above and beyond to ensure your financial success. It’s all about building relationships, not just transactions.

Why Choose Five Star Credit Union?

Here’s the deal: Five Star Credit Union offers a range of advantages that make it a top choice for individuals and families seeking financial stability. Some of the key reasons include:

- Lower fees compared to traditional banks.

- Higher interest rates on savings accounts.

- Personalized customer service tailored to your needs.

- Access to a wide array of financial products and services.

The Journey: A Brief History

Every great story starts somewhere, and Five Star Credit Union’s journey is no exception. Founded in [year], Five Star Credit Union began as a small, member-driven organization focused on serving local communities. Over the years, it has expanded its reach while staying true to its core values of integrity, transparency, and community support.

Today, Five Star Credit Union serves thousands of members across multiple locations, offering a diverse range of financial products and services. Its growth is a testament to the trust and loyalty it has built with its members over the decades. But here’s the kicker—it hasn’t forgotten its roots. Five Star Credit Union remains committed to giving back to the communities it serves, making it more than just a financial institution.

Key Milestones

Let’s take a quick look at some of the major milestones in Five Star Credit Union’s history:

Read also:Nashville Man Brain Exposed A Shocking Medical Mystery Unveiled

- [Year] – Official launch of the credit union.

- [Year] – Introduction of online banking services.

- [Year] – Expansion to additional branches nationwide.

- [Year] – Launch of mobile app for seamless banking.

Membership Benefits

Joining Five Star Credit Union is like becoming part of an exclusive club—but without the hefty membership fees. As a member, you gain access to a host of benefits designed to help you achieve your financial goals. From free checking accounts to low-interest loans, the perks are endless.

But wait, there’s more! Members also enjoy exclusive discounts, cashback rewards, and access to financial education programs. These resources are invaluable for anyone looking to improve their financial literacy and make smarter money decisions.

Eligibility Requirements

So, how do you become a member of Five Star Credit Union? It’s surprisingly simple. Membership is open to anyone who meets the eligibility criteria, which typically includes:

- Living or working in the service area.

- Being a family member of an existing member.

- Joining a partner organization or association.

Services Offered

Five Star Credit Union offers a comprehensive suite of financial services designed to meet the needs of its diverse membership base. From everyday banking to complex financial planning, you’ll find everything you need under one roof. Let’s explore some of the key services:

Checking Accounts

Need a reliable place to manage your daily transactions? Five Star Credit Union’s checking accounts have got you covered. With features like unlimited transactions, no monthly fees, and free debit cards, these accounts are perfect for anyone looking to streamline their finances.

Savings Accounts

Saving for the future has never been easier thanks to Five Star Credit Union’s high-yield savings accounts. These accounts offer competitive interest rates and no hidden fees, making them an attractive option for long-term savings goals.

Investment Services

For those looking to grow their wealth, Five Star Credit Union provides a range of investment options, including IRAs, certificates of deposit (CDs), and retirement planning services. Their experienced advisors are here to guide you every step of the way.

Loan Options

Whether you’re buying a home, purchasing a car, or consolidating debt, Five Star Credit Union offers competitive loan options to suit your needs. Their flexible terms and low interest rates make borrowing more affordable and manageable.

Mortgage Loans

Purchasing a home is one of the biggest financial decisions you’ll ever make. Five Star Credit Union simplifies the process with customizable mortgage options, including fixed-rate and adjustable-rate mortgages. Plus, their knowledgeable loan officers are always available to answer your questions.

Auto Loans

Driving off in your dream car doesn’t have to break the bank. Five Star Credit Union offers competitive auto loans with low interest rates and flexible repayment terms. You can even apply online for convenience.

Savings Accounts

Building a strong savings foundation is crucial for financial security. Five Star Credit Union’s savings accounts are designed to help you reach your goals faster. With features like automatic savings transfers and mobile deposits, managing your savings has never been easier.

And let’s not forget about the interest rates. Five Star Credit Union consistently offers some of the best rates in the industry, ensuring your money works harder for you.

Competitive Rates

One of the standout features of Five Star Credit Union is its commitment to offering competitive rates on both loans and savings products. This means you’ll pay less for borrowing and earn more on your savings. It’s a win-win situation!

But how do they manage to keep rates so competitive? The answer lies in their not-for-profit structure. By prioritizing member benefits over profits, Five Star Credit Union can pass savings directly to its members.

Embracing Technology

In today’s digital age, convenience is key. Five Star Credit Union understands this and has invested heavily in technology to enhance the member experience. Their state-of-the-art online banking platform and mobile app allow you to manage your accounts anytime, anywhere.

Some of the tech features include:

- Mobile check deposits.

- Bill pay services.

- Real-time account alerts.

- 24/7 customer support.

Community Involvement

At its core, Five Star Credit Union is a community-focused organization. They believe in giving back to the communities they serve through charitable donations, volunteer work, and educational initiatives. By supporting local businesses and organizations, Five Star Credit Union helps foster economic growth and development.

For example, they partner with schools to provide financial literacy programs, ensuring the next generation is equipped with the knowledge they need to succeed financially. It’s just one of the many ways Five Star Credit Union demonstrates its commitment to making a positive impact.

Frequently Asked Questions

Still have questions about Five Star Credit Union? Here are some common queries answered:

Q: How do I join Five Star Credit Union?

A: Simply visit their website or a local branch to apply for membership. Eligibility requirements vary depending on location, but generally include living or working in the service area.

Q: Are there any fees for joining?

A: Membership fees are typically minimal and vary by location. However, many services, such as checking accounts, come with no monthly fees.

Q: Can I access my account online?

A: Absolutely! Five Star Credit Union offers a robust online banking platform and mobile app, allowing you to manage your accounts from anywhere.

Kesimpulan

Five Star Credit Union stands out as a trusted partner in achieving financial success. With its personalized services, competitive rates, and commitment to community involvement, it’s no wonder so many people choose Five Star Credit Union as their go-to financial institution.

So, what are you waiting for? Take the first step towards financial freedom by joining Five Star Credit Union today. And don’t forget to share this article with friends and family who might benefit from the valuable information we’ve covered here. Together, let’s build a brighter financial future!