Why St Anne's Credit Union Is Your Smart Financial Choice

When it comes to managing your money, finding the right financial partner can make all the difference. St Anne's Credit Union isn't just another financial institution; it's a community-driven powerhouse that prioritizes its members' financial well-being. Whether you're looking to save, borrow, or grow your wealth, this credit union has got your back. Let's dive into why St Anne's Credit Union is the go-to choice for so many people today.

Nowadays, the financial world can feel overwhelming. With so many options out there, it's easy to get lost in the shuffle. But here's the thing—St Anne's Credit Union stands out because it's not just about making money. It's about building relationships and helping people achieve their financial goals. Think of it as your personal finance cheerleader, but way better because they actually have the tools to help you succeed.

Before we dive deeper into what makes St Anne's Credit Union special, let's address the elephant in the room: why should you even care? In a world full of banks and credit unions, it's important to choose wisely. St Anne's Credit Union offers something unique—a blend of personalized service, competitive rates, and a commitment to the community. So buckle up, because we're about to break it all down for you.

Read also:The Fan Bus Your Ultimate Guide To The Ultimate Football Experience

What Exactly is St Anne's Credit Union?

At its core, St Anne's Credit Union is a member-owned financial cooperative. Unlike traditional banks, which operate for profit, credit unions like St Anne's focus on serving their members. This means you're not just a customer; you're a shareholder with a say in how things are run. Cool, right? Let's take a closer look at what this really means:

- Member-owned structure ensures profits are reinvested back into the community.

- Lower fees and better interest rates compared to big banks.

- Personalized service tailored to your financial needs.

So, if you're tired of feeling like just another number at your bank, St Anne's Credit Union might be the breath of fresh air you've been waiting for. And trust me, there's a lot more to explore here.

Why Choose St Anne's Credit Union Over Traditional Banks?

Alright, let's get real for a second. Traditional banks have their perks, but they also come with a bunch of downsides. St Anne's Credit Union flips the script by offering:

Lower Fees That Won't Break the Bank

Ever notice how those sneaky bank fees seem to add up faster than you can say "overdraft"? At St Anne's Credit Union, you won't find hidden charges lurking in the shadows. Their fee structure is transparent and designed to help you keep more of your hard-earned cash where it belongs—in your pocket.

Competitive Rates That Actually Make Sense

Whether you're saving for a dream vacation or looking to secure a loan, St Anne's Credit Union offers some of the most competitive rates around. Here's a quick rundown:

- Savings accounts with higher-than-average interest rates.

- Loan options with lower interest rates compared to traditional lenders.

- No surprises when it comes to APR or hidden charges.

Oh, and did I mention they're always on the lookout for ways to improve these rates even further? It's like having a financial partner who genuinely cares about your success.

Read also:Denise Frazier Video A Deep Dive Into Her Journey Work And Legacy

The St Anne's Credit Union Difference

So what sets St Anne's Credit Union apart from the rest? It's simple: they prioritize people over profits. Here's how:

A Commitment to Community

St Anne's Credit Union isn't just about numbers; it's about people. They actively support local initiatives, charities, and events that strengthen the communities they serve. This isn't just lip service either—they walk the walk and talk the talk.

Personalized Service That Feels Human

In today's digital age, it's easy to feel like just another faceless account number. But at St Anne's Credit Union, you'll find real people who genuinely care about your financial journey. Need advice on budgeting? They've got you covered. Want to plan for retirement? They're here to help.

And let's not forget their awesome online banking platform, which makes managing your finances a breeze. Technology meets humanity in the best way possible.

Understanding the Benefits of Credit Unions

Before we dive deeper into St Anne's Credit Union specifically, let's take a moment to appreciate the benefits of credit unions in general. Here's why they're worth considering:

- Non-Profit Status: Credit unions operate as non-profits, meaning any profits are reinvested into the organization and its members.

- Member Ownership: You're not just a customer; you're a part-owner with voting rights.

- Lower Fees: Credit unions typically charge lower fees than traditional banks.

- Community Focus: Credit unions often prioritize giving back to the communities they serve.

These benefits aren't just buzzwords—they're real advantages that can make a significant difference in your financial life.

How St Anne's Credit Union Supports Financial Wellness

Financial wellness isn't just about having money in the bank; it's about feeling secure and empowered in your financial decisions. St Anne's Credit Union understands this and offers a variety of resources to help members achieve financial peace of mind:

Financial Education Programs

Knowledge is power, and St Anne's Credit Union believes in equipping its members with the tools they need to succeed. From workshops on budgeting to seminars on retirement planning, they've got something for everyone.

One-on-One Financial Counseling

Sometimes, you just need someone to sit down and walk you through your financial situation. St Anne's Credit Union offers personalized counseling sessions to help you navigate even the trickiest financial challenges.

Whether you're trying to pay off debt or save for a big purchase, their team of experts is here to guide you every step of the way.

St Anne's Credit Union: A History of Excellence

Let's rewind for a second and talk about how St Anne's Credit Union became the powerhouse it is today. Founded with a mission to serve the community, the credit union has grown exponentially while staying true to its core values. Here's a snapshot of their journey:

- Established in [Year] with a focus on serving local residents.

- Grown to serve thousands of members across [Region].

- Continuously innovated to meet the changing needs of its members.

Through it all, St Anne's Credit Union has remained committed to its mission of empowering individuals and strengthening communities.

Services Offered by St Anne's Credit Union

Now that you know a little more about St Anne's Credit Union, let's talk about what they actually offer. From savings accounts to loans, they've got a wide range of services designed to meet your financial needs:

Savings Accounts

Looking to grow your nest egg? St Anne's Credit Union offers competitive interest rates on savings accounts, making it easier than ever to watch your money grow.

Loans and Credit Cards

Need a little extra help with a big purchase? Whether you're buying a car, remodeling your home, or consolidating debt, St Anne's Credit Union has loan options that fit your needs.

Investment and Retirement Planning

Planning for the future is important, and St Anne's Credit Union can help. From IRAs to investment accounts, they offer a variety of options to help you secure your financial future.

And let's not forget their amazing online banking platform, which makes managing your finances easier than ever before.

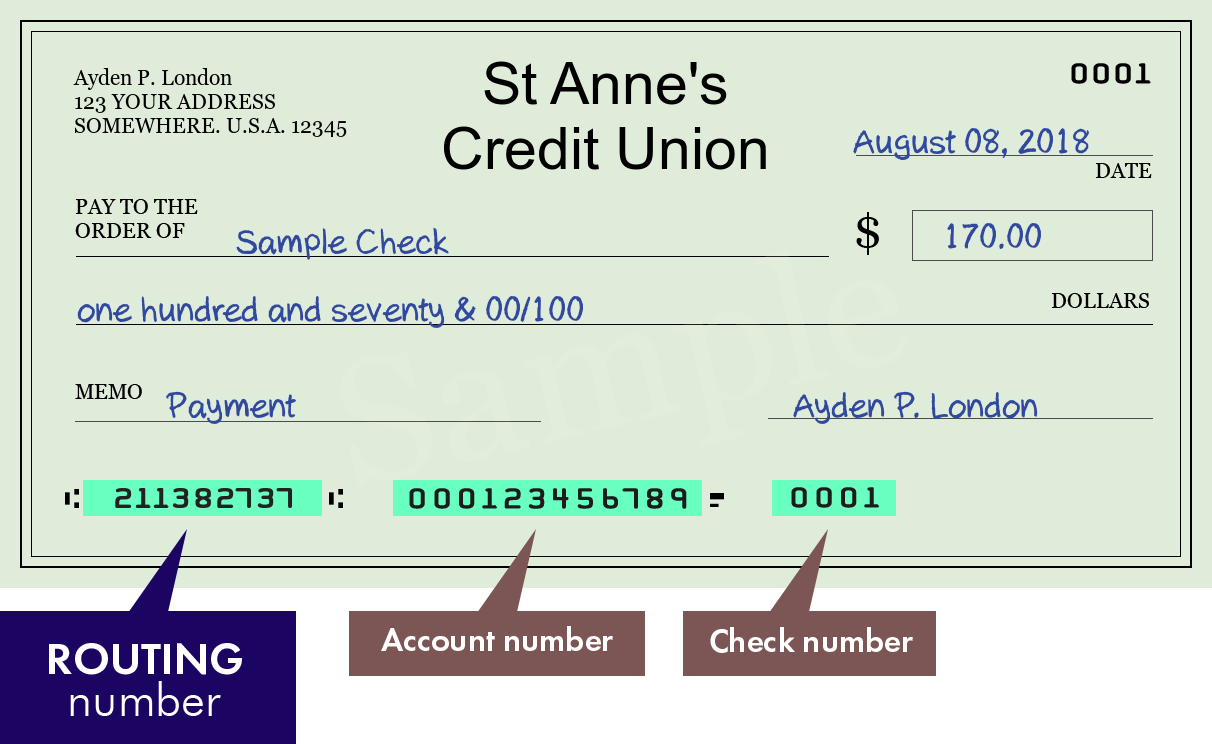

How to Join St Anne's Credit Union

Ready to become a member of St Anne's Credit Union? Here's what you need to know:

- Eligibility requirements vary, so check their website to see if you qualify.

- Membership is usually open to residents of [Region] or employees of partner organizations.

- Once you're eligible, joining is as easy as filling out an application and making a small deposit.

And just like that, you'll be part of a community-driven financial institution that truly cares about your success.

Testimonials: What Members Are Saying

Don't just take our word for it—here's what some satisfied members have to say about St Anne's Credit Union:

"I've been a member for years, and I couldn't be happier with the service. The staff is friendly, and the rates are unbeatable!"

"Switching to St Anne's Credit Union was one of the best financial decisions I've ever made. They truly care about their members."

These testimonials speak volumes about the impact St Anne's Credit Union has on its members' lives.

Conclusion: Why St Anne's Credit Union is the Right Choice

To wrap things up, St Anne's Credit Union offers a unique combination of personalized service, competitive rates, and a commitment to the community. Whether you're looking to save, borrow, or grow your wealth, they've got the tools and resources to help you succeed.

So what are you waiting for? Join the thousands of members who have already made the switch to St Anne's Credit Union. Leave a comment below and let us know what you think about this awesome credit union. And while you're at it, don't forget to share this article with your friends and family who might benefit from knowing about St Anne's Credit Union.

Table of Contents

- What Exactly is St Anne's Credit Union?

- Why Choose St Anne's Credit Union Over Traditional Banks?

- The St Anne's Credit Union Difference

- Understanding the Benefits of Credit Unions

- How St Anne's Credit Union Supports Financial Wellness

- St Anne's Credit Union: A History of Excellence

- Services Offered by St Anne's Credit Union

- How to Join St Anne's Credit Union

- Testimonials: What Members Are Saying

- Conclusion: Why St Anne's Credit Union is the Right Choice