Dade County Federal Credit Union: Your Ultimate Guide To Banking Redefined

Let’s talk about Dade County Federal Credit Union because it’s not just another financial institution; it’s a member-driven powerhouse that’s changing the game for people in South Florida. If you’re looking for a banking experience that’s personal, reliable, and truly community-focused, this credit union has got your back. Whether you’re a long-time resident of Miami-Dade or someone who’s just moving into the area, Dade County Federal Credit Union is here to offer more than just banking services—it’s offering peace of mind.

Now, why should you care about this credit union? In today’s world, where big banks often feel impersonal and profit-driven, Dade County Federal Credit Union stands out as a refreshing alternative. This isn’t just about opening an account or getting a loan—it’s about becoming part of a community that prioritizes its members’ financial well-being above all else. Let’s dive into what makes this place so special.

Before we get too deep into the nitty-gritty, let me tell you something cool. Dade County Federal Credit Union isn’t just about numbers and transactions. It’s about people—real people with real needs who deserve real solutions. So if you’ve ever wondered whether there’s a better way to manage your finances, stick around because we’re about to break it all down for ya.

Read also:Influencers Gone Wild The Untold Story Of Chaos Fame And Fortune

What Exactly is Dade County Federal Credit Union?

Dade County Federal Credit Union, or DCFCU for short, is a member-owned financial cooperative that serves individuals and businesses in Miami-Dade County. Unlike traditional banks, DCFCU operates on a not-for-profit model, meaning any earnings go back into improving services and benefits for its members. This structure ensures that members, not shareholders, are the ones reaping the rewards.

Founded in [year], the credit union has grown significantly over the years, expanding its reach while staying true to its core mission: empowering members through financial education, affordable products, and exceptional customer service. It’s not just about offering checking accounts or mortgages—it’s about helping members achieve their financial goals one step at a time.

Why Choose a Credit Union Over a Bank?

- Credit unions are member-owned, so decisions are made with the best interests of members in mind.

- Lower fees and better interest rates compared to many big banks.

- More personalized service because credit unions tend to focus on building relationships with their members.

- Access to exclusive member benefits, such as discounts on loans and financial counseling services.

Think about it this way: when you join a credit union like Dade County Federal Credit Union, you’re not just another customer in a long line of faceless accounts. You’re a valued member whose voice matters, and that’s a big deal.

Membership Requirements for Dade County Federal Credit Union

So, you’re probably wondering who can join Dade County Federal Credit Union. The good news is that membership is open to anyone who lives, works, worships, or attends school in Miami-Dade County. That’s a pretty broad range, so chances are, you’re eligible! Plus, some employers and organizations have partnerships with DCFCU, which means even more people can take advantage of their services.

To become a member, all you need to do is open a share savings account with a minimum deposit of $5. Yup, just five bucks gets you in the door, and from there, you gain access to a wide range of financial products and services. It’s that simple.

Benefits of Being a Member

Once you’re a member of Dade County Federal Credit Union, you unlock a whole host of perks. Here’s a quick rundown:

Read also:Nashville Man Brain Exposed A Shocking Medical Mystery Unveiled

- Competitive Rates: Enjoy lower interest rates on loans and higher returns on savings accounts compared to most banks.

- Free Checking Accounts: Say goodbye to hidden fees with no-cost checking options.

- Financial Education: DCFCU offers workshops, webinars, and resources to help members improve their financial literacy.

- Community Involvement: As a member, you’ll feel proud knowing that your participation supports local initiatives and charities.

It’s like joining a club where everyone wins—except instead of winning trophies, you win financial stability and peace of mind. Not bad, right?

Services Offered by Dade County Federal Credit Union

Let’s talk about the meat and potatoes—what exactly does Dade County Federal Credit Union offer? The list is pretty impressive, and it covers everything from everyday banking needs to major life milestones. Here’s a snapshot:

Personal Banking Services

For your day-to-day financial needs, DCFCU has got you covered with:

- Checking accounts with no monthly fees.

- Savings accounts with competitive interest rates.

- Debit cards and mobile banking for convenience.

- ATM access through a nationwide network.

Whether you’re managing your budget or saving up for a dream vacation, these services make it easy to stay on top of your finances.

Loans and Credit Solutions

Need a little extra cash to buy a car, pay for school, or remodel your home? Dade County Federal Credit Union offers a variety of loan options, including:

- Auto loans with low interest rates.

- Mortgages for first-time homebuyers and seasoned homeowners alike.

- Personal loans to cover unexpected expenses.

- Credit cards with rewards programs and no annual fees.

Plus, they provide free credit counseling to help members improve their credit scores and manage debt effectively.

How Dade County Federal Credit Union Supports the Community

One of the things that sets Dade County Federal Credit Union apart is its commitment to giving back. Through various programs and partnerships, DCFCU actively supports local schools, non-profits, and community organizations. They also sponsor events and initiatives aimed at promoting financial wellness and economic development in Miami-Dade County.

For example, they’ve partnered with local schools to teach kids about saving and budgeting, ensuring that the next generation grows up financially savvy. They also host free seminars for adults on topics like retirement planning and identity theft prevention. It’s all part of their mission to empower the community and create a brighter financial future for everyone.

Get Involved with DCFCU

As a member, you can participate in these community efforts by volunteering at events, attending workshops, or simply spreading the word about the great work DCFCU is doing. Your involvement helps strengthen the connection between the credit union and the community it serves.

Financial Education Resources

Knowledge is power, and Dade County Federal Credit Union knows that. That’s why they offer a wide range of financial education resources designed to help members make informed decisions about their money. From online courses to one-on-one counseling sessions, there’s something for everyone.

Online Learning Tools

Through their website, members can access:

- Interactive budgeting tools.

- Webinars on topics like investing and credit management.

- A library of articles and videos covering everything from saving for college to planning for retirement.

These resources are available 24/7, so you can learn at your own pace and on your own schedule.

Security and Privacy at Dade County Federal Credit Union

In today’s digital age, protecting your personal and financial information is more important than ever. Dade County Federal Credit Union takes security seriously, employing advanced technologies and best practices to safeguard member data.

They offer features like:

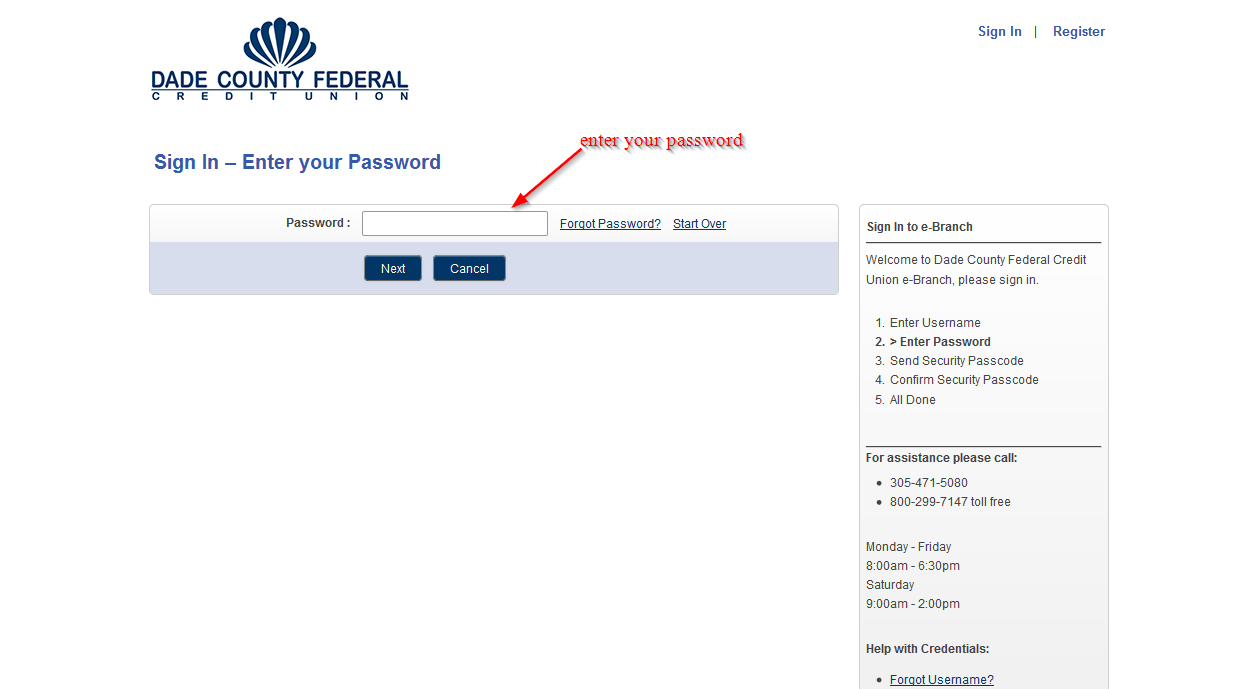

- Two-factor authentication for online banking.

- Fraud monitoring for credit and debit cards.

- Identity theft protection services.

Plus, their team of experts is always on hand to answer questions and address concerns related to security. With DCFCU, you can rest easy knowing your information is in good hands.

Testimonials from Happy Members

Don’t just take our word for it—here’s what some satisfied members have to say about Dade County Federal Credit Union:

“I’ve been a member for years, and the service has always been top-notch. Whenever I have a question or issue, they’re quick to respond and resolve it.” – Maria R.

“The loan rates are unbeatable, and the staff is so friendly and helpful. I’d recommend DCFCU to anyone looking for a trustworthy financial partner.” – Juan P.

These testimonials speak volumes about the credit union’s dedication to its members and the quality of their services.

How to Join Dade County Federal Credit Union

Ready to become a member? The process is quick and easy. Just follow these steps:

- Visit a branch or go online to complete the membership application.

- Make a $5 deposit into a share savings account.

- Start enjoying the benefits of membership!

Whether you prefer to handle everything in person or online, DCFCU makes it simple to get started. And once you’re a member, you’ll wonder why you didn’t join sooner.

Final Thoughts and Call to Action

In conclusion, Dade County Federal Credit Union offers a unique and valuable alternative to traditional banking. With its focus on member satisfaction, community involvement, and financial education, it’s the perfect choice for anyone looking to take control of their finances in a supportive environment.

So what are you waiting for? Head over to their website or stop by a branch to learn more about how Dade County Federal Credit Union can help you achieve your financial goals. Don’t forget to share this article with friends and family who might benefit from the information—after all, knowledge is power, and power is something we could all use a little more of these days.

Have questions or comments? Drop them below, and let’s keep the conversation going!

Table of Contents

- What Exactly is Dade County Federal Credit Union?

- Why Choose a Credit Union Over a Bank?

- Membership Requirements for Dade County Federal Credit Union

- Benefits of Being a Member

- Services Offered by Dade County Federal Credit Union

- How Dade County Federal Credit Union Supports the Community

- Financial Education Resources

- Security and Privacy at Dade County Federal Credit Union

- Testimonials from Happy Members

- How to Join Dade County Federal Credit Union