Indian River County Property Appraiser: Your Ultimate Guide To Property Valuation

So, you’ve probably heard the term “Indian River County Property Appraiser” floating around, especially if you’re diving into the world of real estate, taxes, or property management. But what exactly does it mean? Why should it matter to you? Well, buckle up, because we’re about to break it down in a way that’s easy to digest and packed with useful insights. Whether you’re a homeowner, an investor, or just someone curious about property values, this is the info you need to know.

Property appraisal might sound like a boring topic at first glance, but trust me, it’s more important than you think. This isn’t just about numbers on a piece of paper; it’s about understanding the value of your most significant asset—your property. And in Indian River County, having the right information can save you thousands of dollars in taxes or help you make smarter financial decisions.

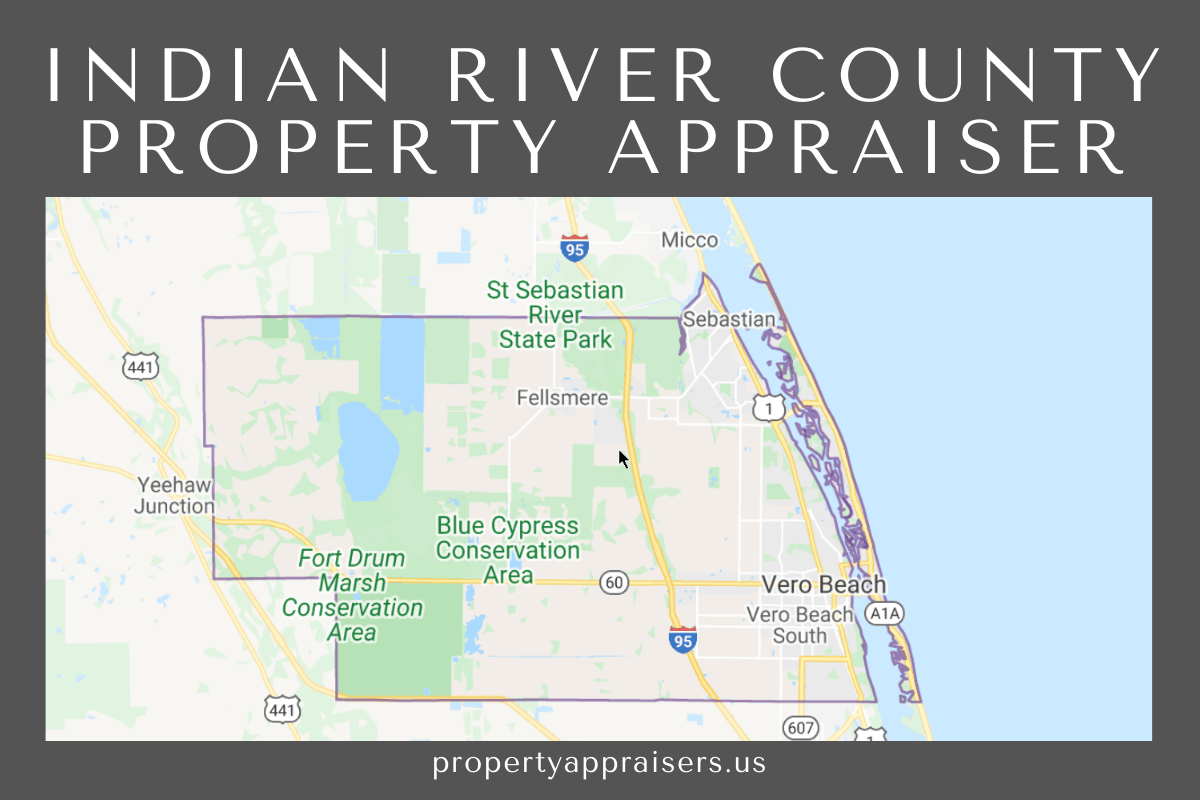

Now, if you’re wondering why Indian River County specifically matters, it’s because every county has its own unique rules, regulations, and processes when it comes to property appraisal. So, whether you’re buying, selling, or simply maintaining your property, understanding the local system is key. Let’s dive deeper into this, shall we?

Read also:Jack Sullivan Rudd The Rising Star In The Entertainment World

Table of Contents

- What is an Indian River County Property Appraiser?

- The Role of the Property Appraiser

- How Property Appraisal Works in Indian River County

- Why Property Appraisal is Important

- Common Mistakes to Avoid

- The Impact of Property Appraisal on Taxes

- Tips for Homeowners

- Challenges Faced by Appraisers

- Useful Resources for Property Owners

- Future Trends in Property Appraisal

What is an Indian River County Property Appraiser?

Alright, let’s start with the basics. An Indian River County Property Appraiser is basically the person—or team of people—responsible for determining the value of properties within the county. Think of them as the official number-crunchers who decide how much your house, land, or commercial building is worth for tax purposes.

But here’s the thing: they don’t just pull numbers out of thin air. These appraisers use a combination of data, market trends, and specific evaluation methods to come up with an accurate valuation. It’s not as simple as looking at the size of your house or the number of bedrooms. There’s a lot more that goes into it, and we’ll get into the details later.

Oh, and one more thing? The property appraiser’s office isn’t just some random department. They play a crucial role in the local government structure, ensuring that property taxes are fair and equitable for everyone. So yeah, they’re kind of a big deal.

Who Can Become a Property Appraiser?

Not just anyone can become a property appraiser. In Indian River County, these professionals are usually highly trained and certified. They need to have a deep understanding of real estate markets, construction costs, and local regulations. Plus, they’ve gotta pass some pretty rigorous exams to prove they know their stuff.

And let’s not forget the ethical standards. Property appraisers are expected to be impartial and unbiased. That means no playing favorites or tweaking numbers to benefit certain individuals. It’s all about fairness, folks.

The Role of the Property Appraiser

So, what exactly does a property appraiser do on a day-to-day basis? Well, their job revolves around three main tasks: assessing, auditing, and educating. Let’s break it down.

Read also:Bubble Letter G Unleash Your Creativity With This Fun Typography Trend

- Assessing: This is the bread and butter of their job. Appraisers assess the value of properties by analyzing factors like location, size, age, and condition. They also consider market trends and recent sales of similar properties in the area.

- Auditing: Appraisers review property records to ensure accuracy. This includes checking for errors in property descriptions, tax exemptions, or other details that might affect valuation.

- Educating: Believe it or not, appraisers often spend time educating property owners about the appraisal process. They explain how values are determined, why taxes might increase, and what homeowners can do if they disagree with the assessed value.

Now, here’s the kicker: appraisers don’t set your property taxes. Their job is to determine the value of your property, and then the tax rate is applied based on local government budgets. So if you’re upset about your tax bill, don’t blame the appraiser—blame the policymakers.

How Often Are Properties Appraised?

In Indian River County, properties are typically appraised annually. However, the actual value might not change every year, especially if there haven’t been significant improvements or market shifts. But if you’ve added a new pool, renovated your kitchen, or the neighborhood has become super trendy, chances are your property value will reflect those changes.

How Property Appraisal Works in Indian River County

Let’s dive into the nitty-gritty of how property appraisal actually works. It’s not as complicated as it seems, but there are a few key steps involved:

- Data Collection: Appraisers gather information about your property, including public records, building permits, and recent sales of comparable properties.

- Site Visits: Sometimes, appraisers will visit your property to get a firsthand look. Don’t worry, they’re not snooping around—they’re just gathering data to ensure accuracy.

- Analysis: Using specialized software and formulas, appraisers analyze all the data to determine the fair market value of your property.

- Notification: Once the valuation is complete, you’ll receive a notice in the mail letting you know the assessed value of your property.

Now, here’s where things can get interesting. If you disagree with the assessed value, you have the right to appeal. More on that later.

What Factors Influence Property Value?

There are several factors that can influence the value of your property. Some of the most important ones include:

- Location, location, location! Properties in desirable neighborhoods tend to have higher values.

- Size and layout of the property. Bigger homes with more bedrooms and bathrooms usually command higher prices.

- Age and condition of the property. Older homes might be worth less unless they’ve been well-maintained or updated.

- Market conditions. If the real estate market is booming, property values are likely to rise.

Why Property Appraisal is Important

Property appraisal isn’t just some bureaucratic formality—it plays a critical role in the local economy. Here’s why it matters:

First off, property taxes are a major source of revenue for local governments. The money collected from these taxes funds schools, roads, emergency services, and other public amenities. Without accurate property appraisals, it would be impossible to distribute these funds fairly.

Secondly, property appraisal affects homeowners directly. If your property is overvalued, you could end up paying more in taxes than you should. Conversely, if it’s undervalued, you might miss out on potential profits if you decide to sell. It’s all about balance.

And let’s not forget the impact on buyers and sellers. Accurate appraisals help ensure that transactions are fair and transparent, protecting both parties from getting ripped off.

How Does Property Appraisal Affect You?

Whether you’re a homeowner, landlord, or investor, property appraisal has a direct impact on your finances. Here are a few ways it affects you:

- Property taxes: As mentioned earlier, your tax bill is based on the assessed value of your property.

- Selling your home: If you’re planning to sell, a higher appraisal value can mean a better sale price.

- Refinancing: Lenders use appraisal values to determine how much they’re willing to loan you.

Common Mistakes to Avoid

When it comes to property appraisal, there are a few common mistakes that people make. Let’s take a look at some of the biggest ones and how to avoid them:

- Ignoring the Appraisal Notice: Don’t just toss that letter in the trash. Take the time to review it carefully and make sure everything is accurate.

- Not Requesting an Appeal: If you believe your property has been overvalued, don’t hesitate to file an appeal. You have the right to challenge the appraisal.

- Overestimating Improvements: Just because you added a new deck doesn’t mean your property value will skyrocket. Be realistic about the impact of renovations.

By avoiding these mistakes, you can ensure that your property is fairly valued and that you’re not paying more than your fair share in taxes.

Tips for Filing an Appeal

If you decide to appeal your property appraisal, here are a few tips to help you succeed:

- Gather evidence to support your case, such as recent sales of similar properties in your area.

- Be polite and professional in your communication with the appraiser’s office.

- Attend the appeal hearing in person if possible—it shows that you’re serious about the issue.

The Impact of Property Appraisal on Taxes

Let’s talk taxes. Property taxes are calculated by multiplying the assessed value of your property by the local tax rate. So, if your property is appraised at $300,000 and the tax rate is 1%, your tax bill would be $3,000.

But here’s the thing: tax rates can vary depending on where you live within Indian River County. Some areas might have higher rates due to additional services or infrastructure projects. That’s why it’s important to stay informed about local government budgets and tax policies.

Oh, and don’t forget about exemptions. Depending on your situation, you might qualify for a homestead exemption, senior citizen discount, or other tax breaks. Be sure to check with the property appraiser’s office to see if you’re eligible.

How to Save on Property Taxes

Here are a few strategies to help you save on property taxes:

- Monitor your property’s assessed value annually and appeal if necessary.

- Take advantage of available tax exemptions and deductions.

- Stay informed about local government policies that might affect your tax bill.

Tips for Homeowners

If you’re a homeowner in Indian River County, there are a few things you can do to make the property appraisal process smoother and more beneficial for you:

First, keep your property records organized. This includes building permits, renovation receipts, and any other documents that might affect your property’s value. Having these on hand can make the appraisal process go much faster.

Second, maintain your property. Regular upkeep can help ensure that your home remains in good condition, which can positively impact its value. And if you’re planning any major renovations, consult with a professional to ensure they’ll add value rather than detract from it.

Lastly, stay engaged with the community. Attend local government meetings, ask questions, and stay informed about changes that might affect your property taxes or valuation.

What to Do If You Disagree with the Appraisal

If you believe your property has been unfairly appraised, here’s what you can do:

- Review the appraisal notice carefully and identify any discrepancies.

- Gather evidence to support your case, such as recent sales of similar properties.

- File an appeal with the property appraiser’s office within the specified timeframe.

Challenges Faced by Appraisers

Being a property appraiser isn’t all sunshine and rainbows. These professionals face several challenges in their line of work:

One of the biggest challenges is dealing with rapidly changing market conditions. If the real estate market is volatile, it can be difficult to accurately assess property values. Appraisers have to